Get Ready for the Socialist Calculation Debate Redux

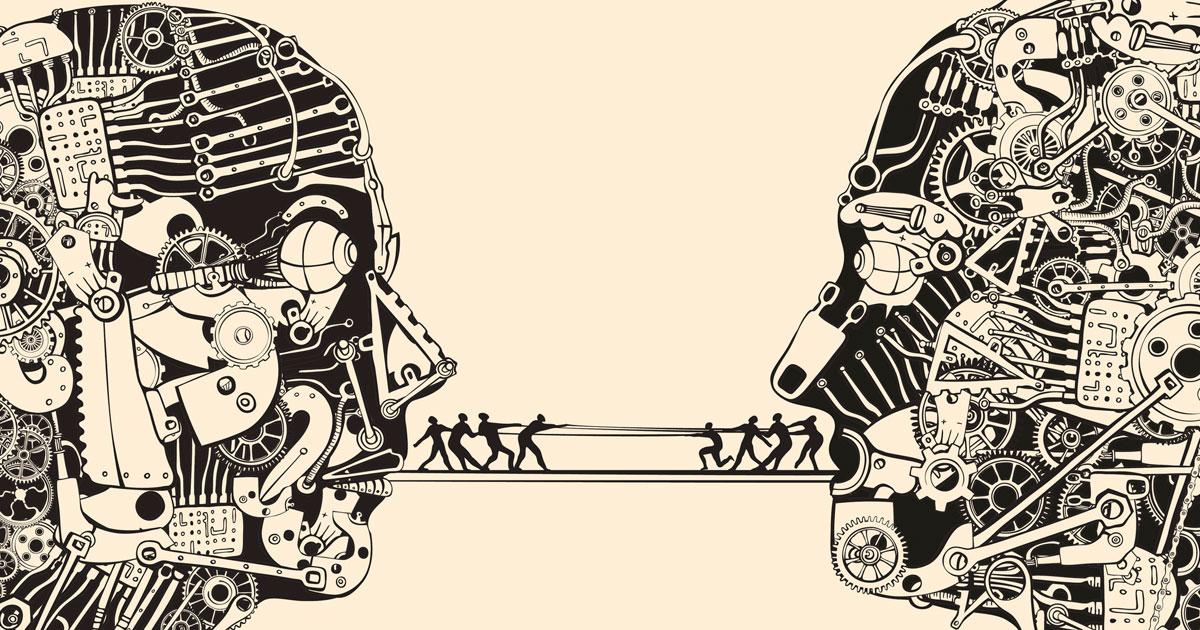

It has been just over a century since Ludwig von Mises started the socialist calculation debate, one of the main contenders for fight of the century in economic theory. The debate raged primarily throughout the 1930s, but was also active in the 1920s and 1940s. Although Austrians started and comprised the one side of the debate, historians of economic thought have typically concluded that they ultimately lost.

Austrians disagree and maintain that the responses, primarily by Taylor (1929) and Lange (1936, 1937) missed the point. Specifically, they forced Mises’s argument into a general equilibrium framework within which a solution was readily available. But Mises’s actual argument is fundamentally based in entrepreneurship: the value-creative undertakings of imaginative, uncertainty-bearing promoters and producers seeking to make profits from satisfying consumers’ future wants.

The ‘Solution’ to Mises’s Challenge

First Fred M. Taylor and then Oskar Lange drafted a solution to Mises’s problem that produced a trial-and-error structure to mimic the market but without private ownership of the means of production. Specifically, they suggested that the government can keep a master list of prices (or, simply, numbers) for all factors of production and then update it in response to revealed shortages and surpluses. In other words, local producers would call in their status and the master list would be updated to reflect reality: factors in short supply would get an increased list price and relatively abundant factors would get a price reduction.

Their solution accepts Mises’s identification that socialism without prices could not rationally allocate scarce factors of production toward their higher-valued uses. Lange even sarcastically suggested that Mises should be honored for having allowed socialists to produce a solution to the previously unknown problem. Writes Lange (1936, p. 53), “a statue of Professor Mises ought to occupy an honourable place in the great hall of the Ministry of Socialisation or of the Central Planning Board of the socialist state.”

The problem with this solution, however, is that it places the cart before the horse. The calculation problem is not simply that there are no numbers to use when allocating resources, but that those numbers in a market economy mean something: they refer to the best guesses of what consumers will value. This is accomplished through the “division of intellectual labor” as entrepreneurs, aiming to create value for future consumers, compete and bid for the resources, thereby establishing present prices as reflections of expected future prices. Taylor and Lange, in contrast, determine prices of factors after the fact—their prices in the present reflect shortages and surpluses of the past.

Under general equilibrium, this important difference disappears because the model does not include time. But time, as Austrians know, is core to understanding the economy.

An Interest Reborn

The Austrian explanations for why the presented solutions were not actual solutions have largely, if not exclusively, fallen on deaf ears. But even though most non-Austrians assume Mises’s argument was properly rejected, we have recently seen renewed interest in the debate, both its economic arguments (especially Mises’s) and the sociology of the debate. This new interest has come from non-Austrians.

For example, Andy Denis takes on Mises’s argument in the Review of Political Economy. Denis accepts more of Mises’s argument than Taylor and Lange, and suggests that both the original argument and problem are accurate. But, he argues, Mises went too far by stating that private property is necessary for its solution. He proposes that common ownership but several control, much as how public corporations see a separation of ownership and management, is sufficient, and thus that private property is unnecessary. (GP Manish and I published a response in the same journal.)

Another example: Tiago Camarinha Lopes wrote in the Cambridge Journal of Economics that Austrians are attempting to rewrite history by suggesting Mises’s argument was never properly responded to. He argues that Mises, seeking to be taken seriously, positioned his argument in the general equilibrium theory that was used at the time. Modern Austrians, Lopes suggests, reinterpret Mises’s original argument using later (but inapplicable) Austrian conceptions of the market as an entrepreneurially driven process. (I have written a response to this paper together with Mark Packard and Cris Lingle that is currently under review at the journal.)

Central Planning Romanticism on the Rise

Add to this new scholarly interest the popularity of the recent developments in political rhetoric and policy, where previously acknowledged limitations to government power, spending, and interventionism are being thrown out entirely. The most striking example is the new kid on the economics block “modern monetary theory” (or MMT), which views fiat currency as a magical resource. To MMTers, creating more money out of thin air can provide society with vast public works programs while feeding private businesses in the market. The best part? It is free.

Proponents of MMT also tend to think this has no negative consequences for the economy.

But MMT is only the most recent central planning romanticism. Emboldened by the money printing since the Great Recession, which has not (yet) had many inflationary repercussions, and the pandemic’s supposedly successful eviction moratoria and stimulus checks, central planning has returned as a promise and solution. Reality is no longer considered a relevant limitation to what glorious government can achieve (or at least promise).

As was the case a century ago, Austrian economics is the only real resistance to this nonsense. But this time things are different.

The Socialist Calculation Debate Redux

When Mises presented his argument that socialism, or the common ownership of the means of production, has no means to calculate and thus cannot economize on productive factors, it was taken seriously. It would have been easy for economists with socialist sympathies to simply ignore Mises’s argument or reject it outright. But they didn’t. Instead, as the examples of Taylor and Lange show, they recognized that Mises indeed had discovered a problem. A decade and a half after the original argument was made, they were still debating it.

While those seeking a proper answer to Mises’s challenge misunderstood (or chose to disregard) Mises’s basis for making the argument—the Austrian observation that the market is an open-ended entrepreneurial process—the point is that they wrestled with and took the argument seriously. And they attempted to produce solutions to it. The list-price solution they came up with is not a very good or appropriate solution, but it should at least count as a good attempt—and it addresses the problem and even suggests a partial solution.

A new socialist calculation debate will be different: Austrians alone cling to economics as a theory that seeks to explain the real world. Non-Austrians, in contrast, are more interested in formalized models of made-up worlds in which elitist planners can “maximize” social utility. Economists are no longer social theorists but theoretical social engineers. They have little interest in understanding the economy per se but instead evaluate policies intended to shape the world. And they are largely ignorant of the field’s history, which means there is little understanding of the ideas of economics. This is particularly evident in the new strands such as MMT, where proponents simply fail to recognize the problems of production, investment, entrepreneurship, and building of productive capital. To MMT, those things are not independent or limited but a means by and for government.

Economists today are not scholars but experts on data and technical analysis. So the battlefield will be very different from where Mises and others fought a century ago. The new battle will, much as was the case with Keynesianism, be fought (and won) in and through policy advocacy rather than scholarship. Here Austrians are at a clear disadvantage: we know and are experts in theory.

Reality Does Not Accept Nonsense

In the end, reality is what matters and, therefore, truth will prevail. But this does not guarantee that we will win the war—or even the next battle. To be victorious and spare the world much suffering, we must make our understanding for how the economy works relevant in this new age. Scholars may have turned their backs on both reality and proper theory, but those who live their lives practicing economics have not and cannot.

These economic actors, and first among them the entrepreneurs, are intuitively Austrians. They have learned from experience and formed an understanding of how the economy works. But they don’t have the words to explain it. And they don’t know why some things work while other things don’t. Austrians have the framework and terminology they (and the world) so desperately need, and they have the ability to shape the future through their actions.

Even though the new generation of central planning proponents choose to disregard reality, it is in the real economy that the battle for the future will take place. The new socialist calculation debate is not a matter of theory but action. It will stand between destructive policymaking and creative economic action.

In this retake of the great debate, the playing field is different. Austrians are tasked with providing the intellectual ammunition that value creators need to defend themselves (and not lose hope). We can and should do this by developing theory, but our efforts must go beyond theorizing. Ideas matter, but they matter when and because they are put into practice. We must make sound economic theory available to nontheorists. There are many ways to accomplish this, including advising entrepreneurs and developing tools for their success, but we cannot afford not to. The future depends on it.