Seven Emergency Spending Reforms Congress Should Consider

Romina Boccia and Dominik Lett

One of these Things Is Not Like the Others

The government, federal or otherwise, has no business model because it is not a business. We know this at the outset because government does not compete in the market for people’s money, as every other business must do. With a

Fiscal Rules Do Not Undermine Investment, But Government Profligacy Does

To prevent public debt from soaring in the wake of the global financial crisis in 2009, Germany has enshrined a “debt brake” in its constitution. The debt brake sets strict limits on federal public debt levels and restrains government borrowing.

Tightwads at the Fed

Mark talks about the Fed's Reverse Repo Operations, which explain the conundrum of the Fed's "tight" monetary policy and new record highs in the stock market. It turns out that the Fed is not a bunch of "tightwads" after all,

A Short History of the Right to Self-Determination

In his 1927 book Liberalism, the radical classical liberal and economist Ludwig von Mises took a strict and expansive view in favor of secession. Specifically, he noted that respect for the right of self-determination required extant states to allow the

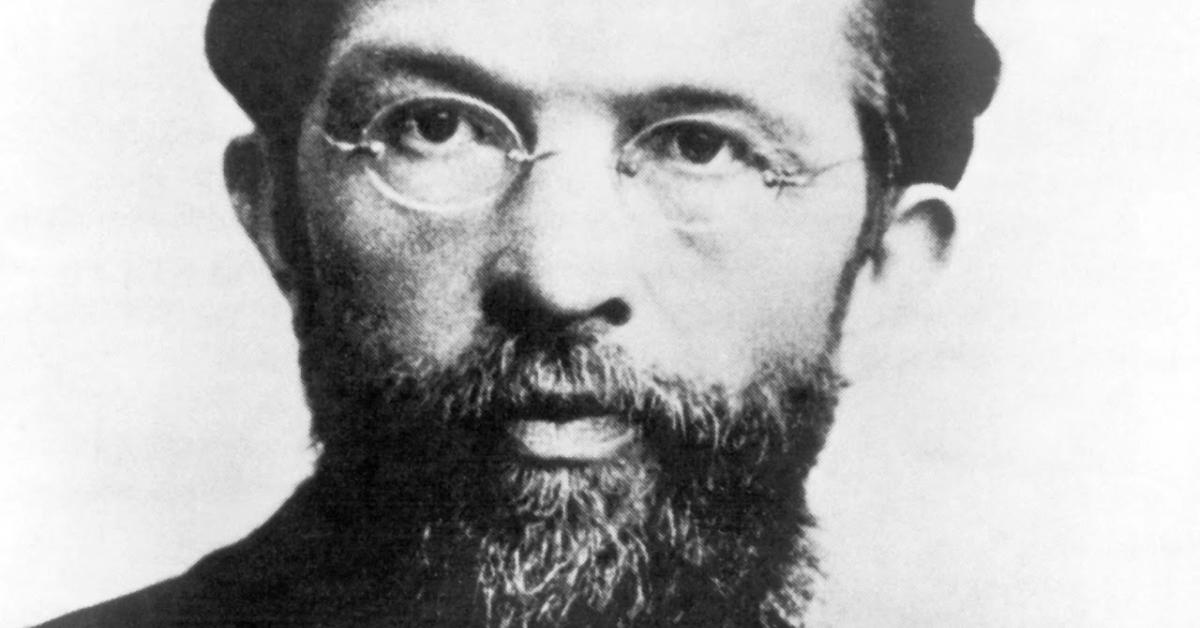

How Carl Menger and the Austrians Helped to Steer Economic Theory in the Right Direction

Adam Smith, in his 1776 book The Wealth of Nations, stipulates the guiding principles of classical economic orthodoxy, establishing guiding principles that will guide the English economic paradigm. Despite a tradition more focused on Colbertism (between the sixteenth and seventeenth

We Like Ike! Joe Salerno on Rolling Back the Ideology of Inflation

Academic VP of the Mises Institute, Joe Salerno, joins Bob to discuss his talk at the Supporters Summit, centering on the mainstream's focus on "rules vs. discretion" in monetary policy. Salerno explains how President Eisenhower's administration marked a pivot away