Federal Flood Insurance Drains Taxpayers

Federal flood insurance was created ostensibly to provide insurance to people who live in flood-prone areas. Not surprisingly, it subsidizes bad home-building decisions and wastes billions of dollars. Original Article: Federal Flood Insurance Drains Taxpayers

From the Invisible Hand to the Invisible Sleight-of-Hand

Why are we using state money instead of market money? Put another way, why can’t we select the money we want to use? Cryptocurrencies are a market alternative, but they haven’t put state money out of business yet. If they

Reason versus Emotion in Economics: A Praxeological Response

The field of behavior economics downplays the role of purposeful praxeology in economics. Austrian economics does not make that error. Original Article: Reason versus Emotion in Economics: A Praxeological Response

No Monetary or Political Bailouts for Belt-and-Road Initiative Debtors

The countries have changed, but the story remains the same. Wealthier countries try to “invest” by lending money to African regimes, where the money disappears. This time, China is the big lender. Original Article: No Monetary or Political Bailouts for Belt-and-Road Initiative Debtors

Cut through the Media Noise, and Remember the Economic Priorities

Modern prosperity is astonishing, but it can quickly disappear if our monetary unit fails. We need to keep up the fight for sound money. Original Article: Cut through the Media Noise, and Remember the Economic Priorities

Seed Corn and Dry Powder

On this week's episode, Mark looks at the financial condition of the government and of American citizens on the cusp of the next recession. The financial condition of the United States Treasury, the Federal Reserve, and the American citizenry is weak; debt

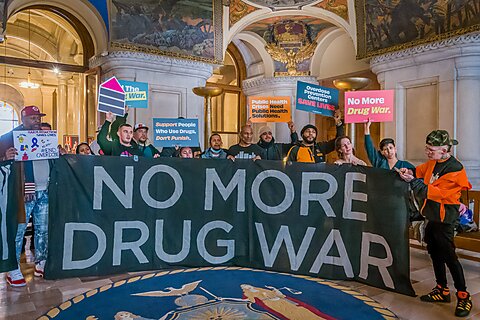

Bad, Worse, Worst: The Misguided Perfectionism of Gavin Newsom

My grandfather used to sing to me, “Good, better, best / never let them rest / till the good is better / and the better is best.” I appreciated that lesson and have been applying it to try to make

Sovereign Debt is Eating the World

Sovereign debt is eating the world. Lining up a financial crash that could make 2008 look like a picnic. How did we get here? In short, governments and central banks deluded themselves into thinking that unlimited deficit spending financed by unlimited money

The Eurozone Disaster: Between Stagnation and Stagflation

The eurozone economy is more than weak. It is in deep contraction, and the data is staggering. The eurozone manufacturing purchasing managers’ index (PMI), compiled by S&P Global, fell to a three-month low of 43.1 in October, the sixteenth consecutive month