College Loans and Hazlitt’s Lesson: Ignoring the Larger Picture

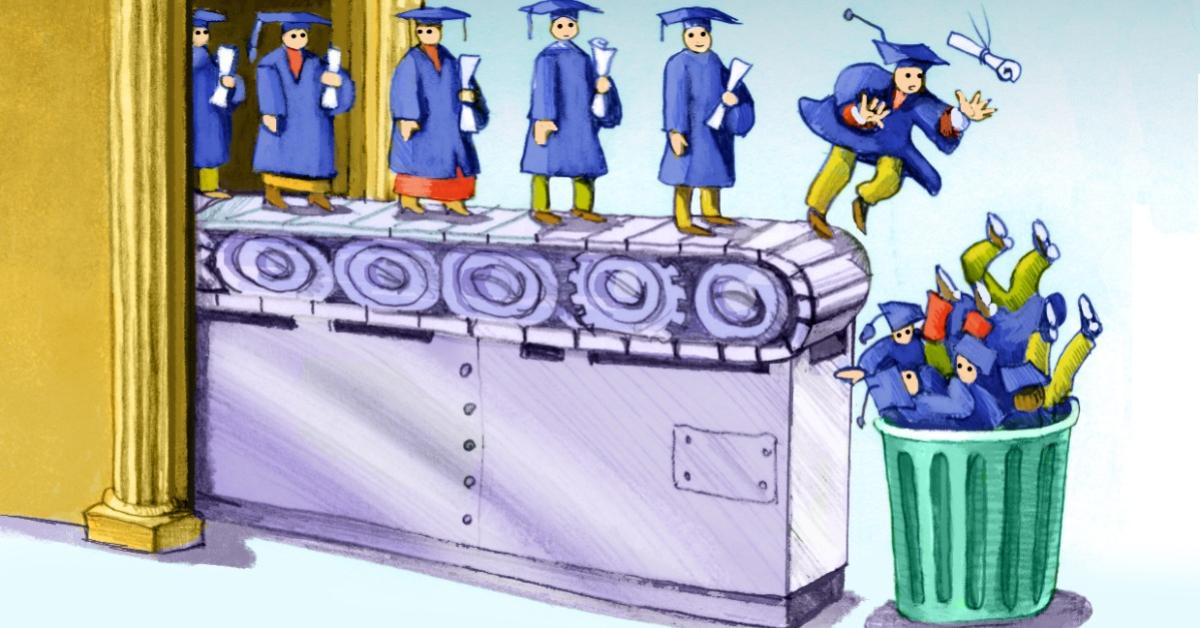

As of 2022 the national student debt reached $1.6 trillion with the average student loan debt at about $28,000. Many former college students are discovering it is difficult to pay back such a large amount of debt. This is especially true of students that graduate with fruitless degrees like sociology, for example. These majors are only good as prerequisites to a master’s degree. Most graduates find themselves working jobs that are completely unrelated to their studies.

For the graduates with useful degrees such as engineering or nursing, large amounts of student loan debt will still be a burden. For some universities the student loan default rates are as a high as 30–40 percent. The debate about whether the government should intervene in the student debt crisis is a hot debate, but few ask why the price of tuition is so expensive in the first place.

The Correlation of Tuition with Government Subsidies

In 1965 the Higher Education Act (HEA) was created. It mandated federal funding directed toward higher education. This was the beginning of the Federal Pell Grant Program and the William D. Ford Federal Direct Loan Program. These government programs provide subsidized loans to be used by students to pay for tuition. The result has been a tremendous increase of the money supply into higher education.

Government-subsidized student loans in 1960 were $11 billion and spiked to $48 billion by 1975. Between 1960 and 1980 public funding for higher education increased 390 percent, but the cost of tuition did not remain unchanged. In 1964 the average cost of tuition adjusted for inflation at a public university was only $248 and by 2007 increased to $8,055.

The Racket

How are colleges spending all the revenue they receive from tuition? Some of this money funds lavish, multimillion-dollar athletic facilities and sports arenas. Some is spent on recreational centers, statues, or art projects that have nothing to do with improving education. The expansion of liberal arts degree programs such as gender studies or African American studies contribute little to a graduate’s value in the workforce. Carnegie Mellon University and the University of Connecticut offer degrees in bag pipping and puppetry, respectively. The University of Texas offers an English class that aims to analyze Taylor Swift songs in the context of traditional literature. It’s doubtful that anyone will agree the thousands of dollars spent on this class reflects the benefit of enrolling in such a class.

The College-Industrial Complex

Colleges are willing to raise the price of tuition so long as student loans are guaranteed. In a free market private loans are funded by a bank, credit union, or the school itself. These lenders must weigh the risk of a loan being paid back. Graduates may or may not be able to pay back their loan. This varies for each student based on the amount of money lent and the type of job they work after college.

Private lenders will not lend an excessively risky amount of money if the chance of the loan being paid back is unlikely. If students were limited to the market value of loans and were not able to pay for their tuition, then attendance would drop until an equilibrium is reached between demand for college degrees is balanced with the price and utility of obtaining one. These were the circumstances before the government got involved, and in most cases, students could work all summer and make enough money to pay for a year of tuition and never have to take out a loan.

Currently under the government-subsidized industry, loans are funded by politically connected financial institutions via the Federal Reserve, which have no risk of bankruptcy when too many people default on their student loans. Schools gladly raise the price of tuition so long as the amount of lending also increases. The result is skyrocketing student debt and the creation of an inflationary bubble.

Capitalism Gets Blamed

Capitalism is an economic system based on the recognition of free markets or the separation of economy and state. Under these circumstances no relationship exists between colleges and government. However, capitalism is often the scapegoat for unaffordable tuition created by the Federal Reserve’s meddling in higher education. It’s argued that capitalism is predicated on selfish greed and responsible for exploiting students, but what’s more exploitative than unmitigated lending to young, vulnerable adults?

Still, socialist ideas of free (costless) education as a solution to student debt has gained popularity. Barack Obama mentioned in his last State of the Union address that he wanted free community college and to reduce student loan borrowers’ payment obligations. Joe Biden’s student loan forgiveness program does just that. Never mind that this does nothing to solve the underlying problem of overpriced tuition and will only create more inflation.

Hazlitt’s Lesson

This may be a benefit to former students and administrators, but only at the expense of the rest of society. Libertarian philosopher and economist Henry Hazlitt correctly identifies this problem in his book Economics in One Lesson. His lesson is based on two main economic fallacies: one, to only observe the immediate consequences of a government policy while neglecting the lasting consequences and two, to only observe the benefactors while neglecting the others.

If the $1.6 trillion of total student debt were completely subsidized through the Federal Reserve’s money creation, the immediate effect is that graduates would have more money to spend on other things, like clothes, food, vacations, cars, and houses for example. More money would circulate to other industries and cause an artificial boom in the economy.

This is the immediate consequence and focuses only on the benefit of college graduates and administrators. However, it ignores all the working class or anyone who did not attend college and are now on the hook for indirectly paying for college graduates’ tuition. The lasting consequences would result in the inevitable economic bust due to the mismatch between supply and demand. Wealth that was produced in other industries would be squandered on rising prices only to benefit the educational industrial complex.

If college tuition were priced according to market forces in a free economy, then the graduates would be largely debt free while still having the opportunity to accumulate wealth. All the cronies in the college system would have to find more valuable work in other areas of the economy. The net result would be a more productive, wealthier, less inflationary society.