OPEC- A CARTEL FAILURE

The post OPEC- A CARTEL FAILURE appeared first on The Economic Transcript.

Stay in Touch With Us

Odio dignissim qui blandit praesent luptatum zzril delenit augue duis dolore.

Email

magazine@example.com

Phone

+32 458 623 874

Addresse

302 2nd St

Brooklyn, NY 11215, USA

40.674386 – 73.984783

One of the most famous examples of a cartel given by many economists is the Organization of Petroleum Exporting Countries (OPEC). According to the OPEC countries, the major objective of the organization is “Unification and coordination of petroleum policies among member countries, in order to achieve just and stable prices for petroleum producers”.

In recent times, we have seen conflicts arising among the member countries due to the ongoing geo-politics. This has not only impacted the global prices of oil but has also built pressure on countries like India to incline towards other members of the organization for its oil demands.

After Iran withdrew from the Iran Nuclear deal, there was pressure on India which pushed it to meet its crude oil demand by importing it from Saudi Arabia and US.

The USA had also imposed sanctions on Iran, which was against the decision of Russia and other OPEC + countries, of increasing oil supplies. Iran’s OPEC governor Hossein Ardebili said, “Saudi Arabia and UAE are turning OPEC into a tool for the US and consequently the organization has not much credit left”.

Furthermore, the emergence of The United States as the major Oil exporter, and the shift towards cleaner energy fuels has impacted OPEC’s oil supplies and has also dismantled its control over the global crude oil supply chain and prices.

Saudi Arabia, a Sunni dominated state which aims to dominate the Arab and the Muslim world, moves in direct contrast with Iran, which is a Shia power. This very fact has always been the root of disagreement among the two founding member states of the organization.

It was reported that on September 10, 2008 members of Saudi Arabia walked out of one of OPEC’s sessions as they did not agree with the cartel’s decision to reduce production. The New York Times reported one of the delegates saying “Saudi Arabia will meet the market’s demand. We will see what the market requires and we will not leave a customer without oil. The policy has not changed.” (Basil, A. 2011)

Nevertheless, we also can’t ignore history which gives us many examples of instability in oil prices which were caused due to wars among the member nations. The Iraqi invasion in Kuwait (1990) had caused lower oil production, resulting in a spike in crude oil prices (Fattouh, B. 2007).

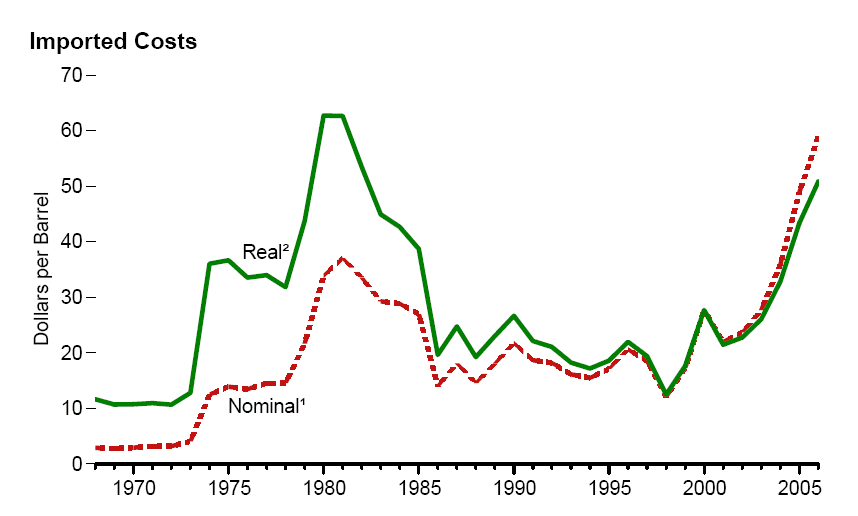

Similarly, the Iran-Iraq war in 1980 had pushed up the global oil prices from $ 14.95 per barrel in 1978 to $ 37.42 per barrel in 1980. After this there was an oil glut, where the prices of oil declined for six years. This accounted for a 46% drop in price (Basil, A. 2011). The reason was acute shortage of demand and over production which led to this situation. At this time Iraq also increased its production hoping to pay for the Iran-Iraq war.

All this ultimately led to a lack of cooperation and unity among the member nations which crippled the oil exports and revenues during the 1980s.

Also, Indonesia had once withdrawn itself from the organization to protect its oil supply interests. Circumstances such as the September 11, 2001 attacks on the US, followed by an invasion of Afghanistan, and the first phase of Iraq War which was marked by invasion of Iraq and its occupation (2003), led to a hike in oil prices. This led Indonesia to be apprehensive about its own interests in the organization.

Many OPEC countries also use the organization to boost their economy, which in turn causes instability in production quotas. They sometimes go on to reduce production, causing a rise in prices. This leads to the violation of one of the objectives of the organization to “seek ways and means of ensuring the stabilization of prices in international oil markets, with a view to eliminating harmful and unnecessary fluctuation.”

Throughout these examples we see that OPEC as a cartel has often failed to regulate the global oil prices. But these drawbacks can be overcome by heavily penalizing, such as imposing sanctions on the member nations, in case a member disobeys the rules of the cartel or if the member does not abide by the amount it had promised to produce. Also, giving incentives to the members that encourage other members to abide by the cartel, would help maintain its stability.

Altogether, these discrepancies in ideas can be sorted through better mutual cooperation amongst the member nations. The members cannot ignore their own benefits that are associated with this collaboration and hence, they should take up individual reforms in their policies so that their contribution towards the organization is not affected due to changing geo-politics of the area.

This can be done by having an exclusive economic budget for the production, extraction and management of petroleum, which should not be disturbed at the times of tension between the members.

The nations need to understand that their individual wellbeing lies in reciprocal cooperation.

Written by- Bhumika Dixit

Edited by- Khyati Kallianpur

The post OPEC- A CARTEL FAILURE appeared first on The Economic Transcript.

On the 5th of January, 2022; a huge controversy erupted. PM Narendra Modi was forced to wait for 20 minutes on a flyover when he was enroute to the National Martyr’s Memorial at Hussainiwala. Due to this, the Prime Minister

To summarize India’s path to growth and development, we often say that India is the second-fastest growing economy and the largest democracy in the world. However, do we truly believe that? If we remove the numbers and see a visual

Menstruation. Did you feel a sense of awkwardness and shyness when you heard this word? Did you whisper it in your friend’s ear when you got it? Did you feel uncomfortable sharing about your periods with your male peers? Or