Let’s Level the Playing Field between the Dollar and Competing Currencies

To be a reliable and useful medium of exchange, money must be durable, portable, divisible, and recognizable, but also scarce. The privileged power of the state to manipulate the scarcity of money has had disastrous consequences for national currency systems

Inflation Is Popular. It’s Great If You’re Already Rich.

The 4.2 percent Consumer Price Index (CPI) bounce for April sent a chill through some traders and financial commentators who had expected a tamer number like a 3.6 or 3.9 percent from last year’s covid price level air pocket. The MarketWatch headline

What Does “Seasonally Adjusted” Mean?

According to mainstream thinking, economic slumps are caused by various shocks. This means that these slumps are caused by unexpected events, which by implication are not known beforehand. Obviously if causes behind various shocks cannot be known in advance, it

Vijay Boyapati Explains Why He Was Right About Inflation in 2010 and Bitcoin in 2018

Vijay Boyapati left a lucrative job at Google in 2007 to move to New Hampshire and campaign for Ron Paul. In this episode, Vijay explains why the other Austrians should have listened to him in 2010 when he warned that

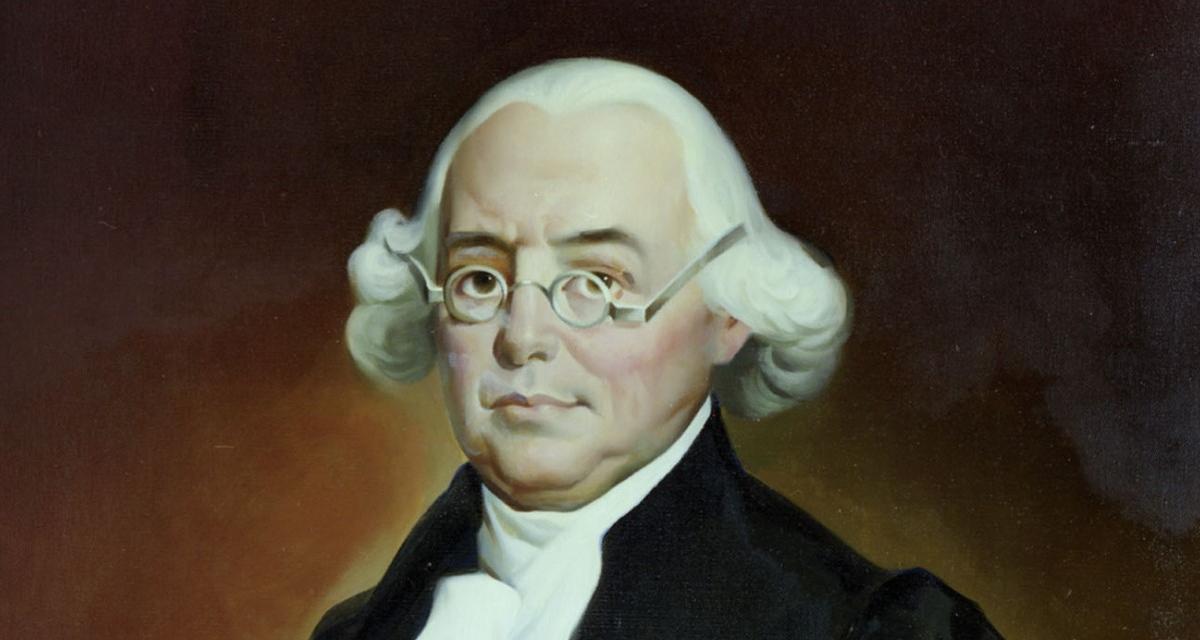

The New Constitution: The Ratification and Amendment Process

[Chapter 19 of Rothbard's newly edited and released Conceived in Liberty, vol. 5, The New Republic: 1784–1791.] A particularly vital aspect of the Constitution was the procedure to be set up for its ratification. The draft proposed that the Constitution be submitted to Congress

How Covid Put an End to Your Right to Due Process

Over a year ago, the covid panic shook the world. We were told it would only be “15 days to flatten the curve” as businesses were locked down, “nonessential” employees were forced out of work (I’ve written about the myth

Per Bylund on the Importance of Good Theory for Good Business

What use is economic theory in business? It’s indispensable. It’s the necessary starting point for all businesses, brands and projects. Only when you have mastered theory can you master the navigation of specific situations, and be confident in your good

Investors Won’t Buy the “Transitory” Inflation Line

The Federal Reserve and European Central Bank repeat that the recent inflationary spike is “transitory.” The problem is that investors do not buy it. Inflation is always a monetary phenomenon, and this time is not different. What central banks call transitory effects, and the impact of

Money-Supply Growth Finally Slows in March, Drops to 10-Month Low

After three months in a row of hitting new all-time highs, money supply growth slowed in March, dropping to a 10-month low. This slowdown, however, does not suggest any significant departure from the past year's high growth in money supply—which came

How Monetary Expansion Creates Income and Wealth Inequality

“Every change in the money relation alters … the conditions of the individual members of society. Some become richer, some poorer.” – Mises, Human Action, p. 414. New money enters the economy at a particular point. It does not enter in