The New Deal and Recovery, Part 8 (Supplement): The Brookings Report

In assessing the New Deal's contribution to economic recovery, I've naturally tended to draw on fairly recent research. That keeps me from being accused of being out of date. But it makes me vulnerable to the charge of overlooking the

Farmer Bills: India’s Step Towards Free Market Economics in Agriculture

Agriculture is the oldest source of employment and wealth generation for India. It affects the life of every single citizen of the country—it provides us with food and the raw materials for scores of items consumed every day. Several other

Reply to “Reply to Whitehead” by Desvousges, Mathews and Train: (4) My treatment of the weighted WTP is biased in favor of the DMT (2015) result/conclusion

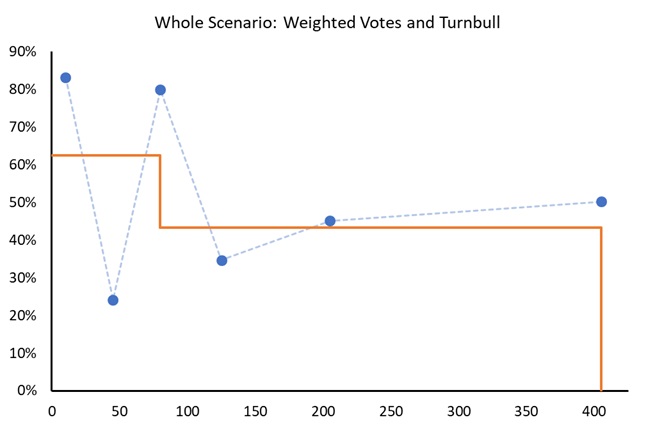

DMT (2020) draw attention to my treatment of the weighted WTP estimates. The regression model for the second scenario has a negative sign for the constant and a positive sign for the slope. When I "mechanically" calculate WTP for the

Reply to “Reply to Whitehead” by Desvousges, Mathews and Train: (2) What is the effect of negative WTP?

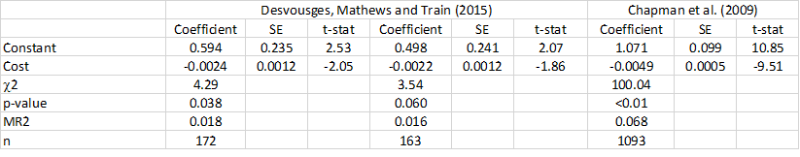

When dichotomous choice CVM data is of low quality, the measure of central tendancy is sensitive to assumptions. As I showed in a paper presented earlier this year (Landry and Whitehed 2020), with the highest quality data it makes no

Reply to “Reply to Whitehead” by Desvousges, Mathews and Train: (1) Is the log-linear model meaningless?

When dichotomous choice CVM data has a negative WTP problem, one of the standard corrections is to estimate a log-linear model and present the median WTP. With many estimated log-linear models the mean WTP is undefined. This is because the

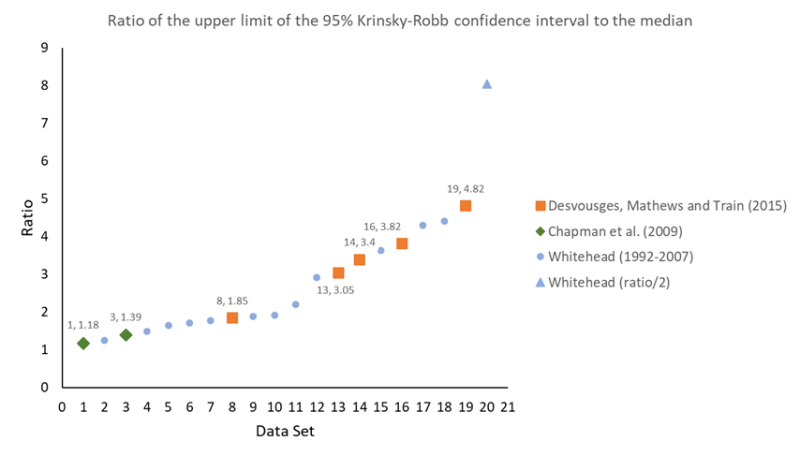

Reply to “Reply to Whitehead” by Desvousges, Mathews and Train: (6) Are the DMT (2015) data problems typical in other CVM studies?

In Whitehead (2020) I describe the problems in the DMT (2015) data. It is full of non-monotonicities, flat portions of bid curves and fat tails. A non-monotonicity is when the percentage of respondents in favor of a policy increases when

The Information Value of Pigouvian Pricing

I recently read an article in the journal Economics and Philosophy, written by Lisa Herzog, which has nothing whatsoever to do with environmental economics but nonetheless I think has interesting implications for it and for Pigouvian pricing in particular. In case

Reply to “Reply to Whitehead” by Desvousges, Mathews and Train (the correction)

As described in the introduction of my (draft) "Reply to 'Reply to Whitehead'", I suspect that I have used the incorrect confidence intervals when analyzing the Desvousges, Mathews and Train (2015) data. Park, Loomis and Creel (1991) introduced the Krinsky-Robb

Reply to “Reply to Whitehead” by Desvousges, Mathews and Train (an introduction)

Desvousges, Mathews and Train (Land Economics, 2015) use the contingent valuation method (CVM) to conduct an adding-up test (i.e., does WTPA + WTPB = WTPA+B?). They use the nonparametric Turnbull estimator and find that the data do not pass the

Google Silently Chucked the Dot (.) in Gmail Addresses; Chaos Followed

Gmail was the most popular fad in the early 2000's when it was rolled out as an invite only free email service by Google. Everyone I knew wanted one.What I did not know was that Gmail would, at any random